#1 Potential future of iron and steel making which has broader applications

When the going gets tough, the tough get going

As a math teacher, my first association with steel is that of a steel ruler popularly used in Indian classrooms to teach middle school students to draw straight lines. Looking back further, my earliest memory of steel is that of a shop in Mumbai’s Matunga market known as Steel Home which prided itself on selling stainless steel utensils which were prized possessions almost as a mark of class distinction embossed with the names of family elders. Only in 2023 at the beginning of my job with Ceres as Manager, Clean Steel, did I truly fathom the sector's arterial role in the ensuing tension between economic development and the net-zero transition.

The International Energy Agency (IEA) estimates that the iron and steel industry consumes 8% of global final energy use and causes 7% of global direct energy-related CO₂ emissions. Much of this is from the blast furnaces and basic oxygen furnaces (BF-BOF) which are key steps in the traditional method of steelmaking

There are various solutions available for decarbonizing the industry. The most prominent include producing Directly Reduced Iron (DRI) employing green hydrogen as a reductant, and using Electric Arc Furnaces (EAF). While climate activists may not fully support these methods, industry practitioners are exploring alternatives like using natural gas as a reductant and implementing carbon capture, utilization, and storage (CCUS) as viable pathways for decarbonizing steelmaking while still using the BF-BOF method. This McKinsey commentary offers a quick overview of the various methods to decarbonize steelmaking.

So what’s beyond these business-as-usual solutions?

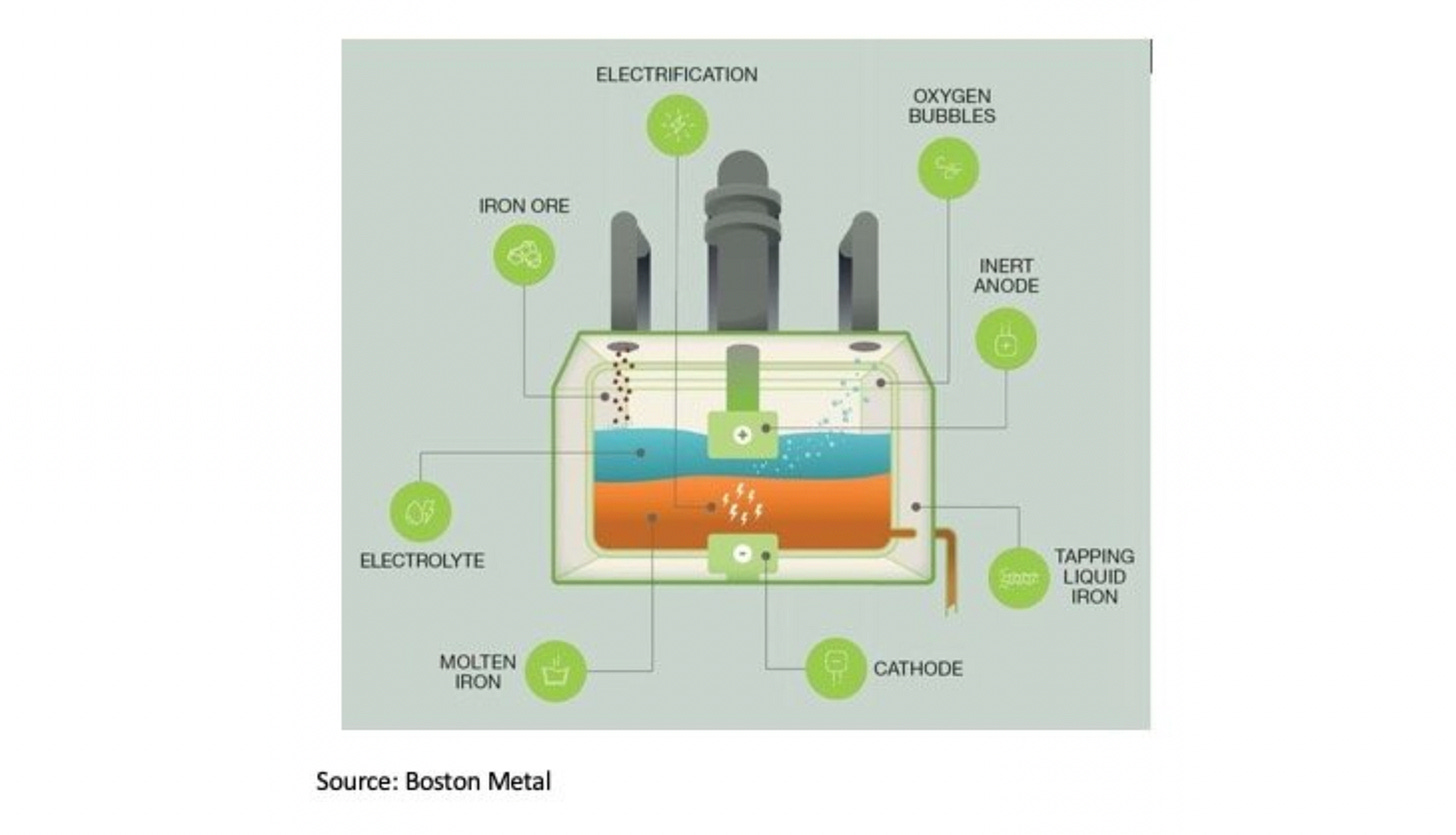

Partially oblivious to climate-related concerns, NASA’s lunar exploration program focusing on extracting metals including iron from the surface of the moon led to the development of molten oxide electrolysis (MOE) as a potential method for ironmaking. In this method, iron ore and a mixture of non-iron oxides are added to an electrochemical cell and electrically heated, converting the non-iron oxides into molten slag. Using a chemically inert anode and passage of electric current, the ore is then split into liquid iron and oxygen gas.

In parallel this process was developed by MIT and Boston Metal, a startup founded by professors from the institution, is now trying to produce steel from MOE and is close to achieving commercialization by 2026. Boston Metal’s plant in Brazil is already operational and running on 100% renewable energy. The firm claims that investing in MOE will be cost-effective compared to blast furnaces with the added recurring cost of carbon capture.

Boston Metal had raised USD 20 million in January 2024 in a funding round. The firm’s investors include leading names such as Aramco Ventures, Microsoft Climate Fund, Breakthrough Energy, and industry majors such as BHP Ventures and ArcelorMittal. Their decade-long journey has led to over 30 active patents and a few more pending approval.

Why is this significant?

Boston Metal advertises three major benefits of MOE:

Zero CO₂ emissions when powered by renewable electricity, replacing the most emissive steps in steelmaking.

Cost-effective as it can convert even low-grade ores directly into high-purity molten iron.

Modular and scalable due to the different sizes of electrochemical cells that are available.

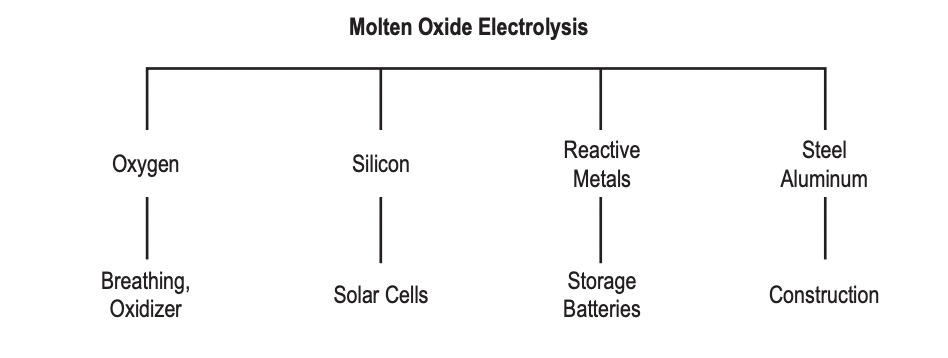

Beyond Boston Metal, innovations with the MOE can produce rare earth metals with near-zero greenhouse gas emissions, critical inputs for a low-carbon economy and the procurement of which is a geopolitical concern for advanced economies. Presently, the extraction of critical and strategic metals through MOE is being investigated by the University of Canterbury in New Zealand.

MOE has several applications in lunar exploration, including the production of oxygen on the moon. NASA believes this technology makes lunar oxygen production attractive. While there may have been updates to NASA’s exploration efforts after the late 2000s, large-scale implementation for extracting the desired metals has yet to be realized.

What drivers can increase the adoption of MOE?

The immediate need to invest in this process is driven by the increasing demand for steel and the necessity to decarbonize steel and iron production, particularly in India. Steel consumption is expected to grow the most in India until 2050.

However, it remains uncertain whether Indian steelmakers or diversified mining companies will invest in MOE to replace traditional blast furnaces or DRI plants. Tata Steel is considering an entirely separate method HIsarna to decarbonize their steelmaking. JSW in their climate action plan has considered switching to scrap-based EAF as a potential alternative to achieve their long-term emissions reduction target. Hence, we might not see MOE grow as much in India purely for the steel industry.

In the medium term of 5-10 years, the need to extract rare earth metals from the moon or even closer home will lead to investment in MOE. Research has already been conducted to extract Tantalum, a metal used in electronics, aerospace, and defence. For lunar applications, scientists have recommended exploring the possibility of laser utilization to generate heat.

In the long run, if the plans of multi-planetary life envisioned by Messrs Musk and Bezos fructifies, MOE will have an increasing role to play in oxygen generation.

What is the potential value of the steel decarbonization market and how can we finance it?

Based on the IEA’s estimate, by 2050, the steel industry is projected to emit 2.7 Gt CO₂ per year, which is 7% more than its current emissions. The World Economic Forum suggests a carbon price for steel that creates a substantial opportunity, estimated between $500 billion and $1 trillion, for decarbonizing the steelmaking process. MOE serves as an alternative to ironmaking through traditional blast furnaces, which are responsible for 70% of the CO₂ emissions in steel production. The total addressable market for decarbonizing ironmaking could range from $350 billion to $700 billion by 2050. This market will likely be diverse, with a significant portion being captured by Electric Arc Furnaces (EAFs) or Carbon Capture, Utilization, and Storage (CCUS), which are more developed and closer to commercialization.

To achieve this goal, will require government funding for research and development in various regions akin to the grants offered by the Inflation Reduction Act. Additionally, leading steelmaking countries could consider exploring multilateral cooperation and technology transfer, especially if the larger aim is to accelerate the extraction of lunar resources. To drive demand which I believe would be tougher, governments will also need to focus on creating demand through green procurement policies, as well as providing incentives to buyers of low-carbon steel produced through MOE.

International Financial Institutions (IFIs) will play a crucial role in derisking large-scale investments and opening doors for further private-sector capital aided by their due diligence. By 2022, only the International Finance Corporation (IFC) and the European Bank for Reconstruction and Development (EBRD) had specific strategies for steel decarbonization. There are at least 10 other development banks that can pick up from the work of IFC and EBRD.

It seems that we might not see many startups similar to Boston Metal, primarily due to the lengthy gestation periods required for research and development, with significant capital infrastructure costs. However, there remains ample opportunity for research focused on process efficiency and innovative methods for extracting other metals while generating oxygen. We can expect not more than 1-2 other startups specializing in producing new outputs from MOE.

These startups will foster spin-offs for academia, as well as attract interest from ClimateTech venture capitalists and corporate venture arms from heavy emission industries. It's interesting to note that many future off-takers become equity investors in innovative startups, as seen in the case of H2 Green Steel (now Stegra). It will be interesting to track who funds MOE startups and research as they emerge and given its diverse uses, investors from all quarters might be interested.

Why did I pick MOE to feature?

There are numerous startups and solutions available to decarbonize steel and iron making but I particularly chose MOE and Boston Metal because I believe that the diverse applications across industries especially in critical minerals and lunar extraction give it a chance to grow beyond just steel. Second, the ability of the process to extract iron from low-grade ores makes it appealing when mining high-quality iron ore becomes a constraint.

Aside, have you reflected on how we can reduce emissions of fluorinated gases from refrigerants? If you have any suggestions, please share them in the comments or send me a direct message.

Image Credits: Green Steel World, Marvel Cinematic Universe, Boston Metal and NASA.